The Maldives today took a decisive step towards building a stronger, more inclusive and climate resilient financial system, as the Maldives Monetary Authority officially launched the National Financial Inclusion Strategy and the National Sustainable Finance Roadmap.

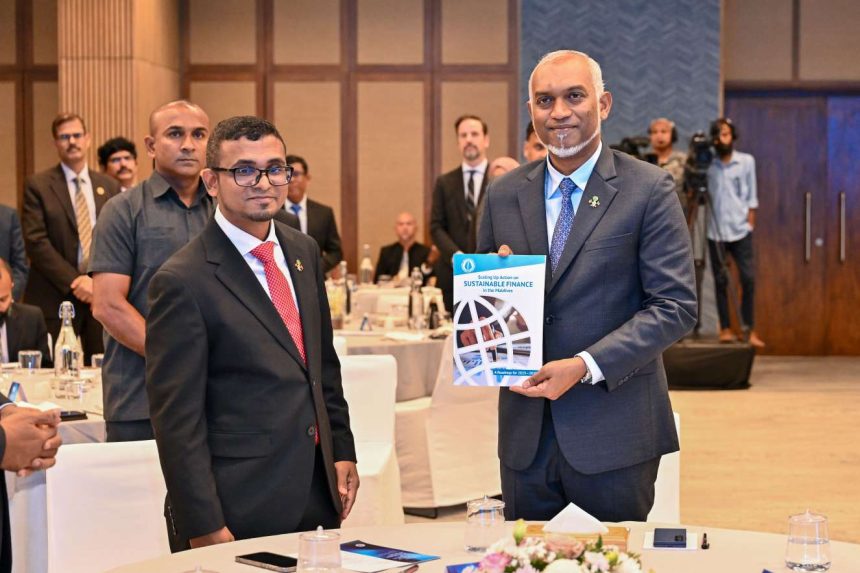

The landmark strategies were inaugurated by President Dr Mohamed Muizzu at a high level ceremony held at Barceló Nasandhura, attended by cabinet ministers, senior government officials, heads of financial institutions, development partners, and key stakeholders across the financial sector.

Together, the two national frameworks are designed to expand access to financial services, improve their effective use, and position the financial system as a central pillar in safeguarding the Maldives against climate change while supporting long term economic and social development.

The launch marks a critical milestone in the government’s broader agenda to modernise and expand the country’s financial architecture. The strategies lay the groundwork for an inclusive and resilient system that supports national development goals, strengthens economic participation, and advances climate and social objectives.

Financial Inclusion at the Core of Economic Progress

The National Financial Inclusion Strategy focuses on improving access to and usage of financial services across the population. Recognising that inclusion goes beyond availability alone, the strategy prioritises financial literacy, consumer protection, and trust in the financial system.

Special emphasis is placed on addressing barriers faced by women, youth, senior citizens, and small, medium and micro enterprises, ensuring that vulnerable and underserved groups are fully integrated into the formal economy.

Sustainable Finance to Tackle Climate Risks

The National Sustainable Finance Roadmap establishes a framework for aligning the financial sector with climate resilience and sustainable development. The roadmap promotes environmentally friendly and socially responsible financial products, while strengthening regulatory frameworks to support sustainable investment.

Key focus areas include climate adaptation and disaster preparedness, renewable energy, and sustainable housing, enabling financial institutions to channel funding towards projects that protect the Maldives’ future.

Governor Highlights Finance as an Engine for National Development

Speaking at the ceremony, , Governor of the Maldives Monetary Authority, described the launch as a defining moment for the sector.

“Ensuring financial stability and building a robust financial system are among the MMA’s foremost objectives. Today also marks the beginning of our efforts to expand the financial system’s role in delivering sustainable development. By widening access to financial services and integrating sustainability into finance, we are reshaping the sector into a key enabler of progress, stability, and opportunity for the entire nation,” he said.

Governor Munawar stressed that successful implementation will require strong collaboration between government agencies, the private sector, and international development partners.

Broad-Based Support and National Vision

The MMA expressed appreciation to government ministries, financial institutions, and international organisations for their contributions in formulating both strategies. Special recognition was also given to the National Financial Inclusion Steering Committee and technical committees for their leadership and dedication throughout the process.

The twin strategies launched today are widely seen as a major step forward in building a future ready financial system for the Maldives, one that promotes inclusive development, supports sustainable growth, and empowers economic progress for generations to come.